This day trading A+ playbook litteraly earned me millions of dollars

Day trading doesn't have to be hard if you can be patient, disciplined, and understand that it's a probability game. ...

We're building the infrastructure to train, fund, and scale the next generation of day traders, without requiring their capital.

Day trading generates billions in annual volume, yet 95% of retail participants fail within their first year, not from lack of skill, but from structural barriers. Capital requirements, inadequate training, and misaligned risk models have kept profitable trading confined to institutional players. We're changing that.

AI-Powered Skill Development. Proprietary adaptive learning engine that identifies and corrects behavioral patterns, accelerating trader proficiency.

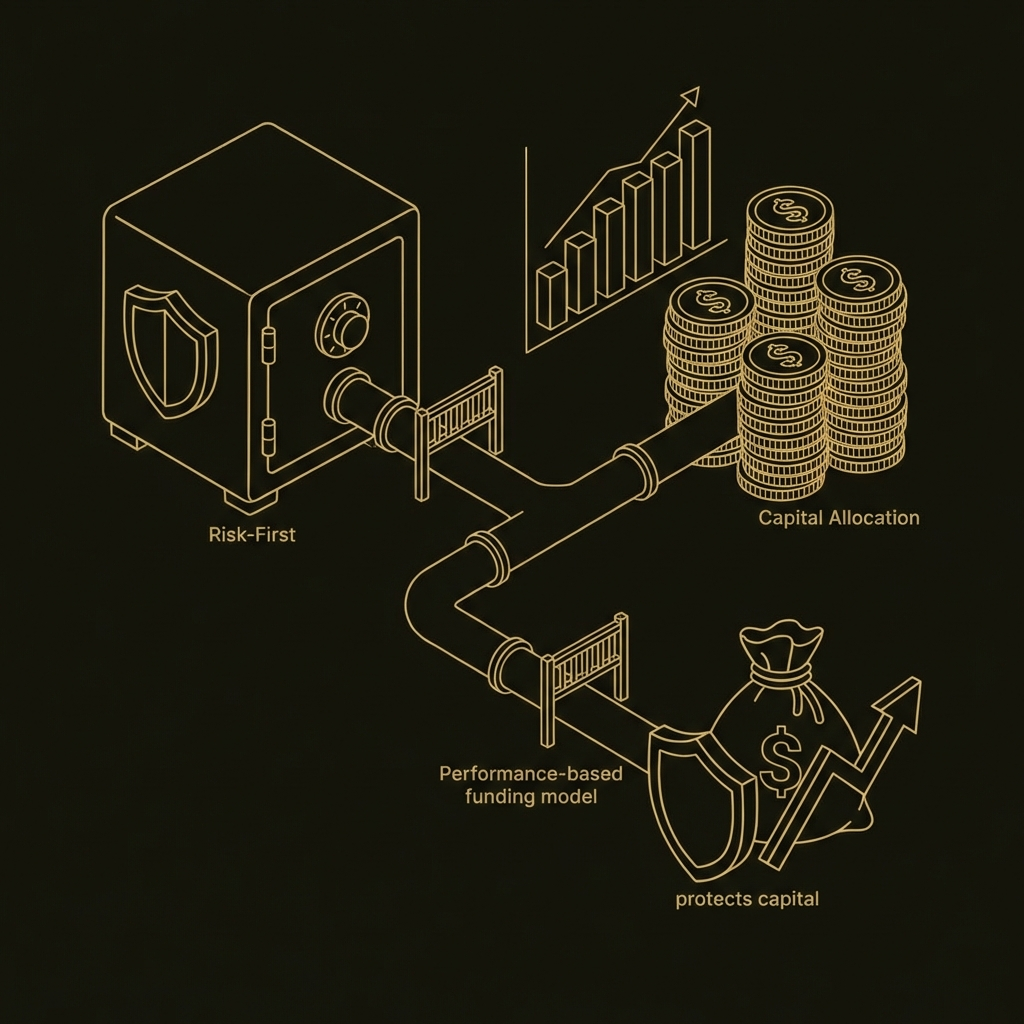

Risk-First Capital Allocation. Performance-based funding model that protects capital while incentivizing disciplined execution.

Aligned Economics. Profit-sharing structure designed for mutual success: traders retain majority upside, we scale through volume, not extraction.

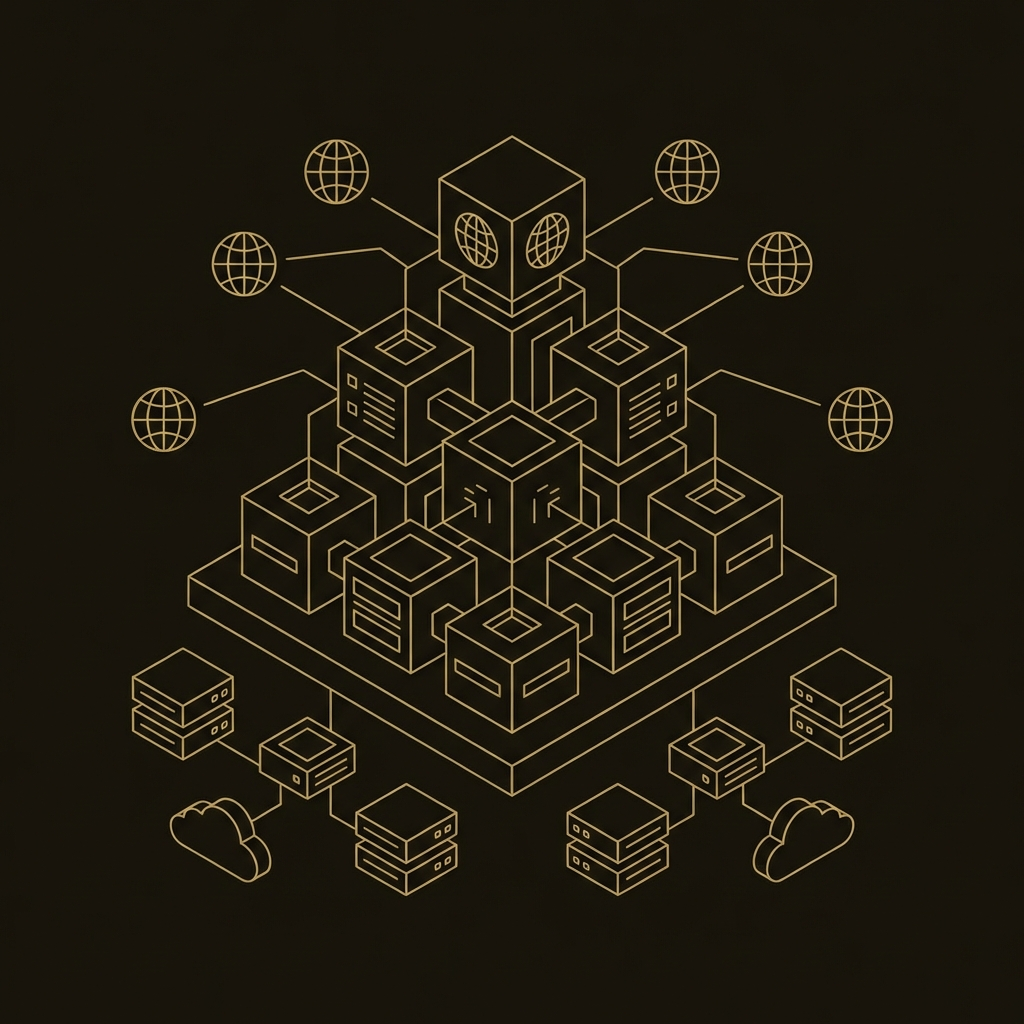

Scalable Infrastructure. Technology-first architecture enabling global reach with minimal marginal cost per user.

How we create value: assessment, simulation, then live capital deployment.

Candidates complete structured curriculum with AI-assisted coaching, demonstrating discipline and pattern recognition before capital access.

Traders operate funded simulation accounts ($50–150K virtual), earning real compensation based on risk-adjusted returns.

Proven performers graduate to live-funded accounts, retaining 100% of profits while we manage downside risk.

Since launch, we've seen significant organic interest from aspiring traders globally, validating market demand for an alternative to traditional prop trading models. Our beta program launches Q2 2026 with select participants.

10,000+ qualified applications · Beta Q2 2026

Entrepreneur with two successful exits. Full-time day trader since 2020 (SEC LTID holder). Author of two books on day trading and gamification.

Engineer with Cutting-Edge AI Innovations and an entrepreneurial mindset. Master retail trader. Jack of all trades with double major (CS + economics).

Day trading doesn't have to be hard if you can be patient, disciplined, and understand that it's a probability game. ...

Welcome to our guide on effectively using triangles, wedges, and channels in your trading strategy. These core chart pa...

TL;DR: Day trading is a fast-paced, high-risk strategy focused on short-term gains through frequent trades, requiring c...